As we take a look at 2015, it’s hard to ignore the significant influence of global events on the year’s IPOs.

2015 was full of landmark events that rippled through financial markets. Everything from the Greek Debt Crisis to the Volkswagen Emission Scandal. The stock markets were volatile.

Bạn đang xem: The 163 Companies That Had Their IPO In 2015

However, over 160 companies, including a domain register, a luxury car brand, an e-commerce platform, and a wearable fitness technology company, still managed to public.

So keep reading to discover which companies had and how they perform today.

Major world events that happened in 2015 that affected the stock market

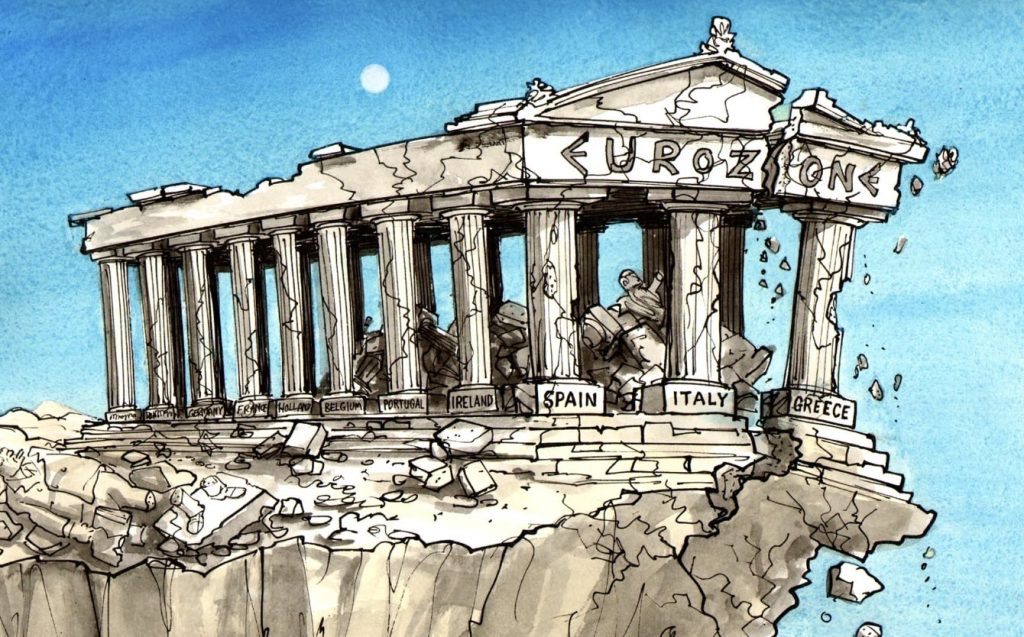

Greek Debt Crisis: The ripple effect of the European Debt Crisis hit Greece harder than most European countries. On July 20, the country reached a bailout agreement with its creditors, averting a potential exit from the Eurozone. As you can imagine, this was bad for financial markets and caused widespread volatility in the stock market.

Xem thêm : Píldora del día después

Volkswagen Emissions Scandal: In September, an investigation revealed that Volkswagen had installed software in its diesel cars to cheat emissions tests. The scandal resulted in recalls of up to 36,000 cars, lawsuits, and significant damage to Volkswagen’s reputation.

Paris Climate Agreement: On December 12, world leaders reached an agreement at the Paris United Nations Climate Change Conference. The agreement resulted in commitments from 193 parties to reduce their emissions to offset the impacts of climate change.

Eight most notable companies that went public in 2015

1. Alarm.com

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $14 per share

- IPO Date: June 26, 2015

Alarm.com provides smart home security and automation solutions for homes, small businesses, and large organizations. They offer a suite of products that allow their customers to monitor, control, and secure their premises. Most of this is done remotely through security systems, video surveillance, energy management, smart locks, and more. Alarm.com even provides professional installation services and 24/7 customer support.

2. Atlassian

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Software—Application

- IPO Price: $21 per share

- IPO Date: December 10, 2015

As an Aussie and Atlassian power user, this is an IPO I was genuinely excited about. They’re a highly regarded software company with collaboration tools like Jira, Confluence, Bitbucket, and Trello. Their tools help teams plan, track, and release projects, share and collaborate on documents, and manage code repositories. Atlassian is the tool of choice for most software companies, so it’s no surprise the share price has steadily increased since the public offering.

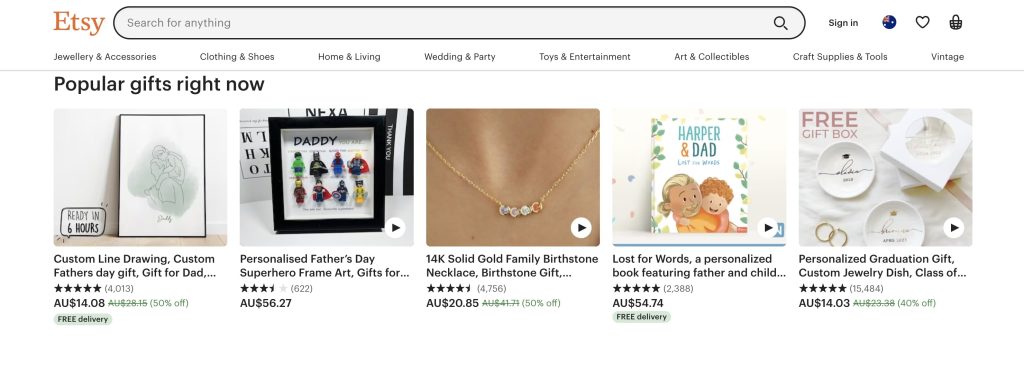

3. Etsy

- Country: United States of America

- Stock Exchange: NASDAQ

- Industry: Internet Retail

- IPO Price: $16 per share

- IPO Date: April 16, 2015

Etsy is an online marketplace that connects buyers and sellers of handmade, vintage, and unique goods. It provides a platform for artists and entrepreneurs to showcase their products to a global audience. Etsy has become popular since its products are customizable, unique, and hard to find elsewhere. They also offer tools that help sellers manage their businesses, including payment processing, shipping, and customer support. In 2021, Etsy acquired a smaller competitor, Depop, for $1.65 billion, making Etsy stock even more valuable to retail investors.

4. Ferrari

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Auto Manufacturers

- IPO Price: $52 per share

- IPO Date: October 21, 2015

Xem thêm : How to Select the Right ICD-10 Code in Three Easy Steps

Ferrari is one of my favorite performance car brands; it’s also one of the few businesses most people are familiar with. But for the uninitiated, Ferrari is an Italian luxury sports car manufacturer. Founded by Enzo Ferrari in 1939, the company produces some of the world’s most iconic vehicles. Ferrari is renowned for its high-performance engines, distinct red color, sleek designs, and racing heritage. When you take a closer look at the business, you’ll notice they also produce other luxury products, including apparel, accessories, and fragrances. In September 2023, there’s set to be a film released about the story of Enzo Ferrari and the growth of the company.

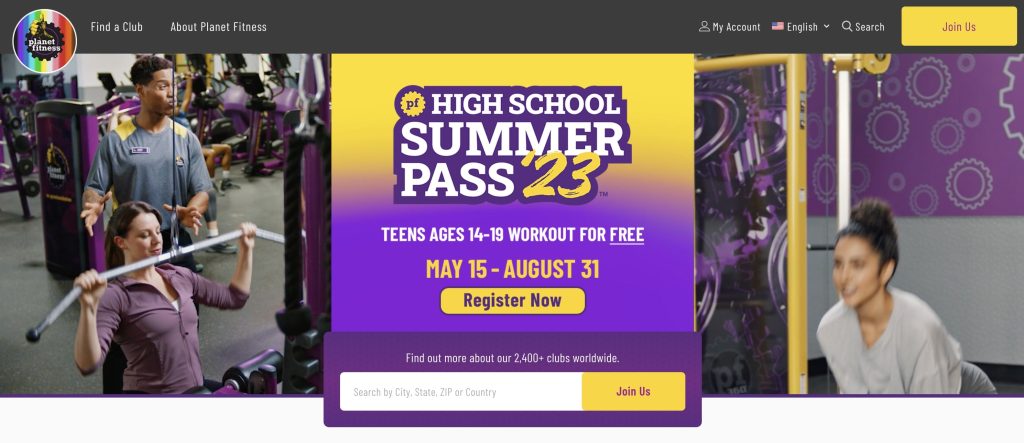

5. Planet Fitness

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Leisure

- IPO Price: $16 per share

- IPO Date: August 6, 2015

Planet Fitness is one of the largest global fitness franchises in the world. They provide affordable and convenient access to their fitness facilities, including access to classes like yoga and Zumba. One of the reasons the chain is so popular is its no-frills approach and “judgment-free zone” which encourages people from all walks of life to join the gym.

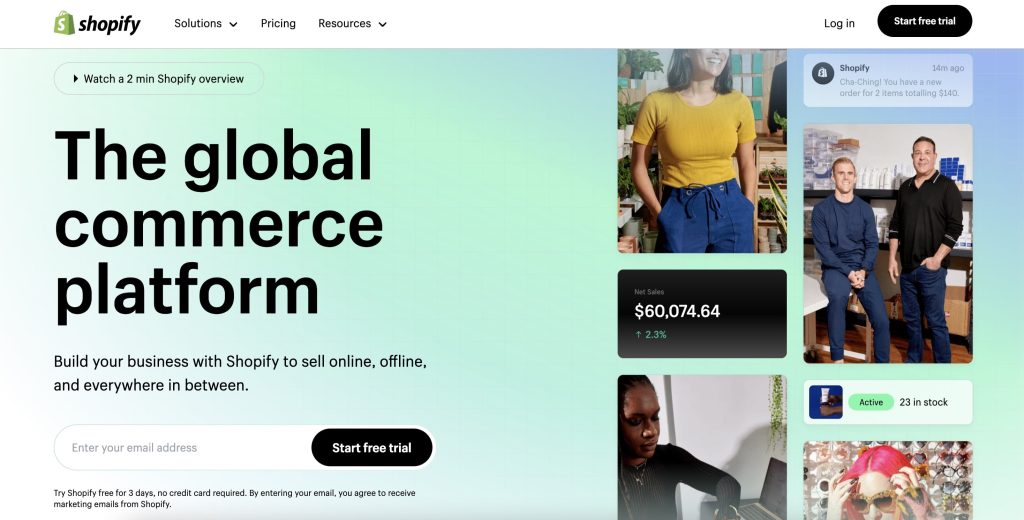

6. Shopify

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Software—Application

- IPO Price: $17 per share

- IPO Date: May 20, 2015

Shopify is my favorite e-commerce platform since it’s easy to set up, use, and scale. They enable businesses to create and manage online stores without coding experience. Shopify has removed the entry barrier when it comes to creating an e-commerce business; anyone can take their idea online in a matter of minutes. According to Tracxn, Shopify has made 13 acquisitions and 15 investments, costing over $2 billion. Their stock price has been trending down since late 2021 but seems to be slowly recovering.

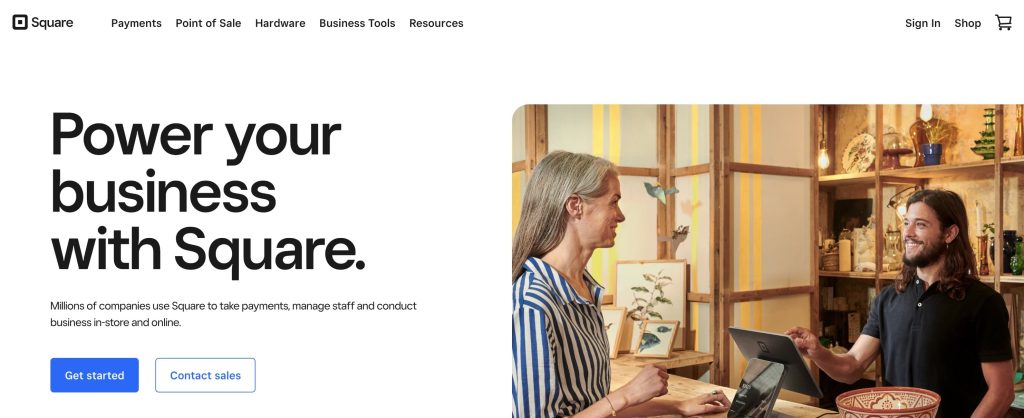

7. Square

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Software—Application

- IPO Price: $9 per share

- IPO Date: November 19, 2015

Square is a FinTech company that provides small businesses with hardware and software to accept and process payments. Their product suite includes Point of Sale (POS) hardware and software, payment processing services (similar to Stripe), and eCommerce applications. If you’ve ever paid for something by tapping your card or phone on a small nifty device, the chances are it was a Square device. In 2021, Square acquired Afterpay for $29 billion in an all-stock transaction.

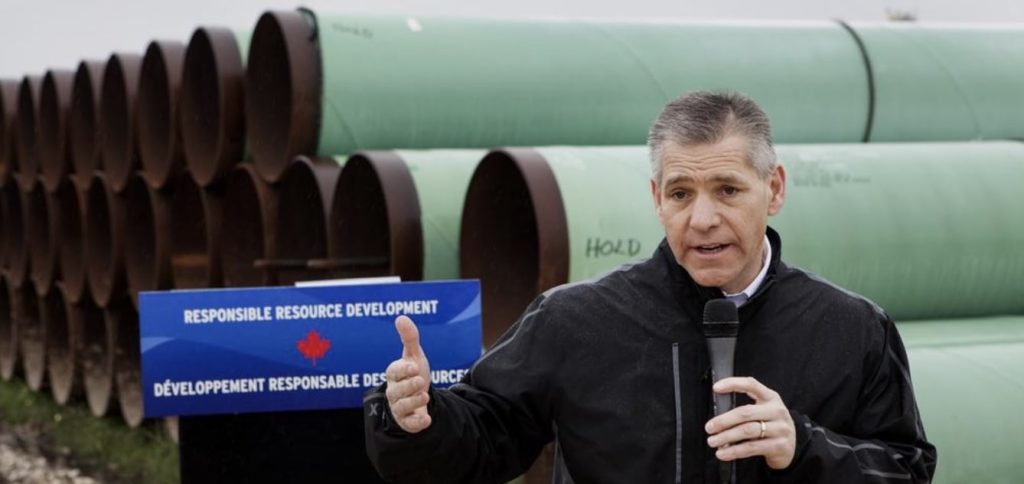

8. Columbian Pipeline Partners (Acquired by TransCanada)

- Country: United States of America

- Stock Exchange: New York Stock Exchange (NYSE)

- Industry: Natural Energy

- IPO Price: $23 per share

- IPO Date: February 6, 2015

Columbian Pipeline Partners was a company that owned and operated more than 15,000 miles of natural gas transmission pipelines (interstate pipelines). The company also held 300 billion cubic feet of underground natural gas storage and a growing portfolio of midstream and related facilities. The 2015 IPO made sense, given the drop in oil and gas prices. However, in 2016 TransCanada acquired them for $13 billion dollars in an all-cash deal.

The 163 companies that had their IPO in 2015

Frequently asked questions

Nguồn: https://vuihoctienghan.edu.vn

Danh mục: Info